As @yieldbasis gets ready to scale up to a $1bn credit line from @CurveFinance, we investigate how the dynamics of the crvUSD system have changed.

Our findings show that as structural crvUSD flows from YieldBasis grow, the stability of the crvUSD system is becoming tightly coupled to BTC price movements, with impacts on rates for Curve's borrowers.

Raising the Cap

72 days since its deployment, YieldBasis has processed over $1bn in volume. Today, founder Michael Egorov raised a new proposal and vote for the Curve DAO to increase its crvUSD credit line from $300m to $1bn.

The credit line will be used to incrementally scale YieldBasis pools, initially utilising $80m and adding the rest over several months based on monitoring of the pools.To better understand the potential impact of raising the cap, we investigated the effects which the current credit line has had on the crvUSD system.

TL:DR

YieldBasis flows are becoming an increasingly large portion of crvUSD volume through PegKeeper pools. These flows are skewed to either the sell or buy side depending on whether BTC is pumping or dumping, as this causes large in/outflow of crvUSD from YieldBasis into Curve.

These one-sided flows create pressure on the peg. This pressure is being effectively managed by the PegKeepers and dynamic borrowing rates. However, both of these are working overtime to keep crvUSD stable, resulting in increased volatility in borrowing rates, which is undesirable for Curve's lending business.

As a result, the stability of the crvUSD system as a whole - which includes not just crvUSD price but also Curve's borrow rates - is becoming tightly coupled to BTC price movements.

Methodology

Using Pangea Studio to build custom datasets, we conducted a flow analysis up to 24th November using a similar methodology to our previous research into structural flows between YieldBasis and Curve. We also analysed the crvUSD peg using the methodology described in our previous research article.

We combined these with other datapoints on PegKeepers, borrowing activity, and BTC volatility to build up a comprehensive picture of the mechanisms driving this complex and dynamic system.

Findings

YieldBasis induces large structural flows through Curve pools, with 93.33% of all YieldBasis volume flowing through crvUSD pools, generating over $859m in volume for Curve.

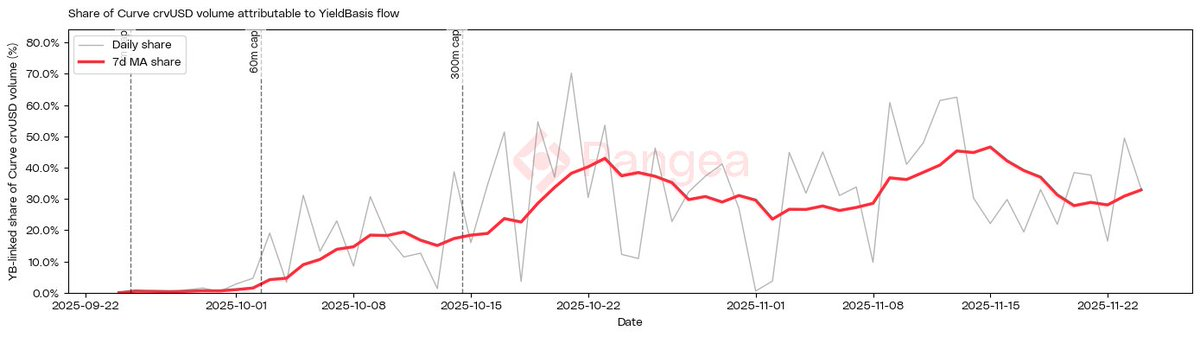

As YieldBasis has increased caps from 6m to the current 300m the proportion of overall crvUSD flow from YieldBasis into Curve pools has increased significantly. YieldBasis flow is now accounting for over 36% of Curve's crvUSD volume, reaching as much as >60% on some days of high BTC volatility.

Share of crvUSD flows from YieldBasis over time

Share of crvUSD flows from YieldBasis over time

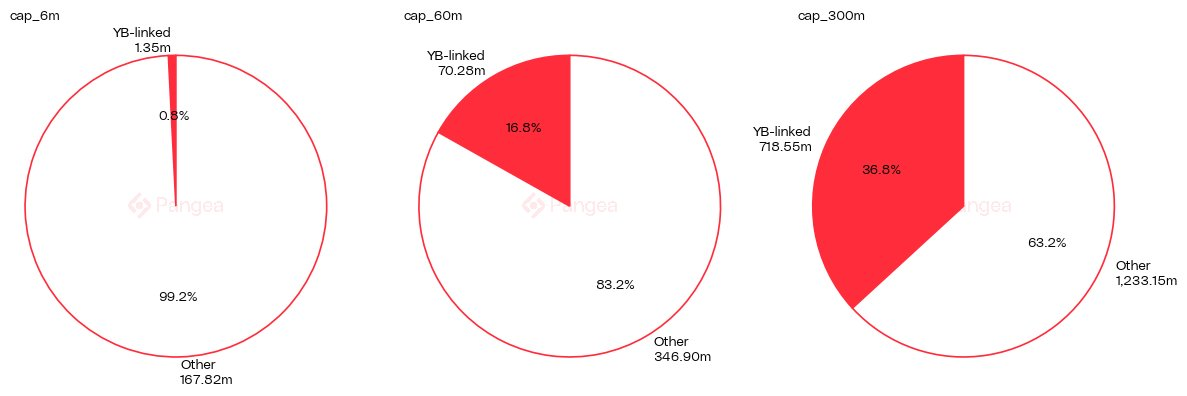

Share of crvUSD flows from YieldBasis in each cap period

Share of crvUSD flows from YieldBasis in each cap period

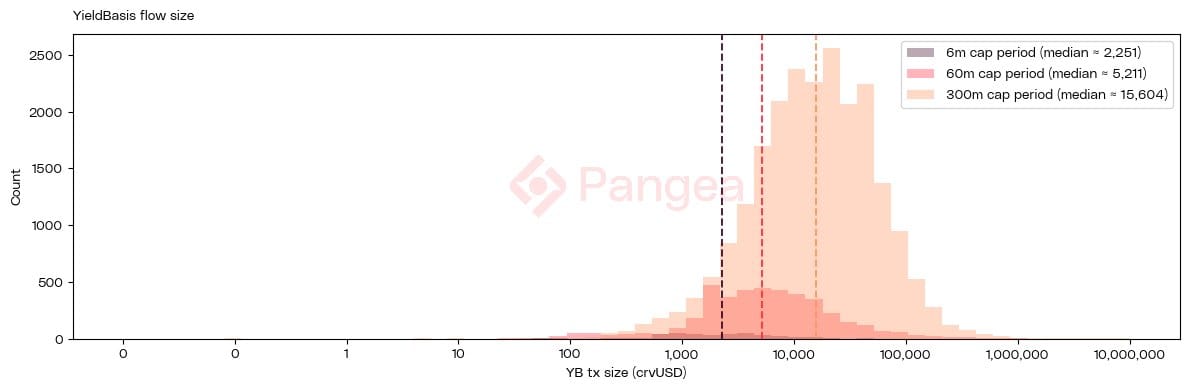

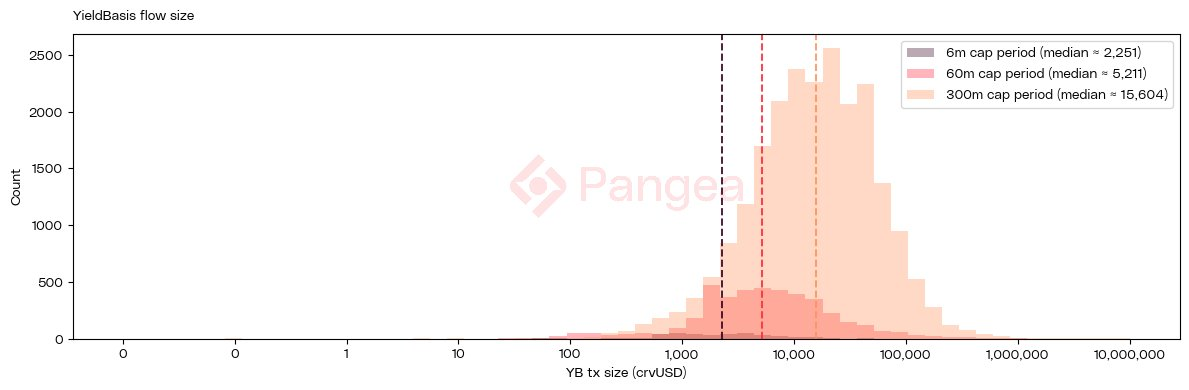

Cap raises have brought deeper liquidity to YieldBasis, increasing the average trade size through the pools to $15.6k, with the largest trade topping $8.84m, which has translated into equally large flows through crvUSD pools. The long tail is important here, as larger pools will soon be pushing 8 figure trades through crvUSD pools.

Size of crvUSD flows from YieldBasis

Size of crvUSD flows from YieldBasis

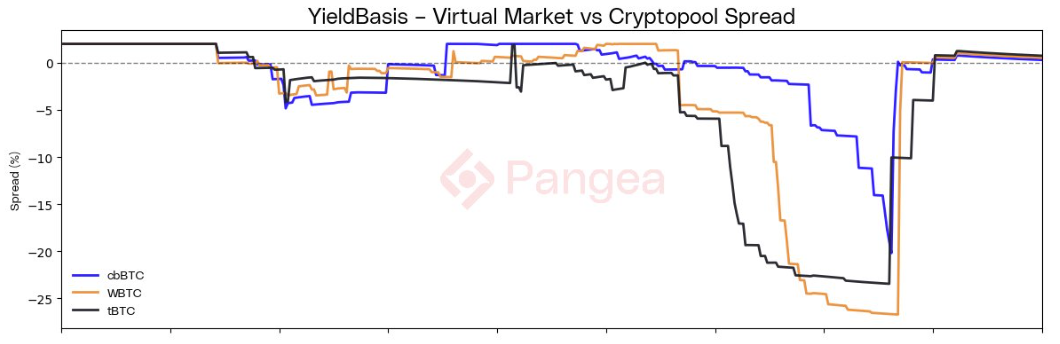

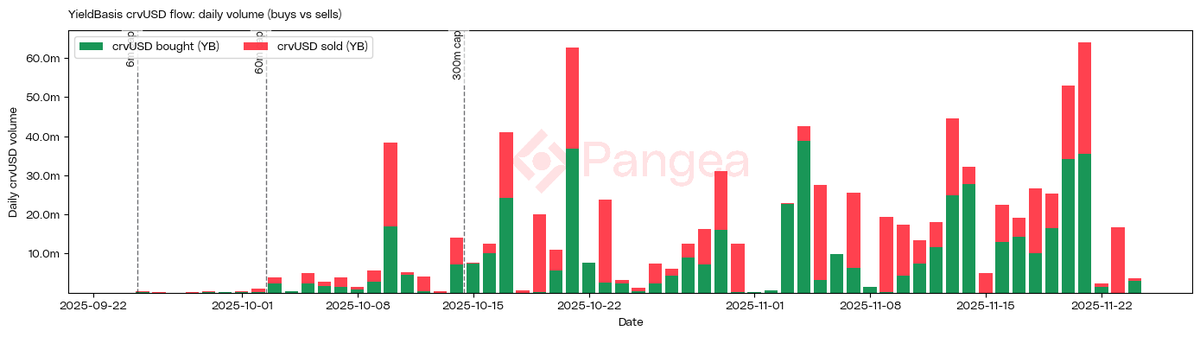

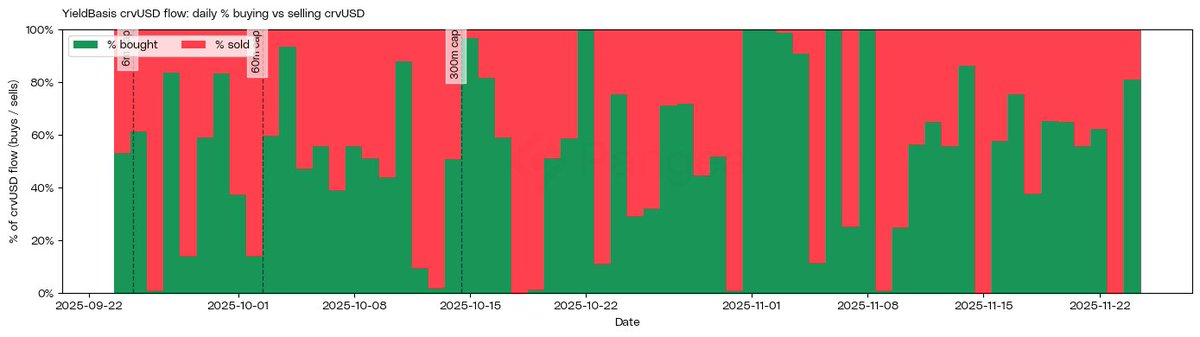

This volume is often highly directional. On some days, YieldBasis almost exclusively buys or sell crvUSD into Curve pools. Rather than acting like a two-sided market-maker, YieldBasis acts as a taker with per-day net-flows in the tens of millions. If liquidity in the crvUSD pools is not sufficient to handle these volumes, these one-sided flows can put pressure on the crvUSD peg.

Daily crvUSD flow from YieldBasis - Buy / Sell volume

Daily crvUSD flow from YieldBasis - Buy / Sell volume

Daily crvUSD flow from YieldBasis - % of Buy / Sell volume

Daily crvUSD flow from YieldBasis - % of Buy / Sell volume

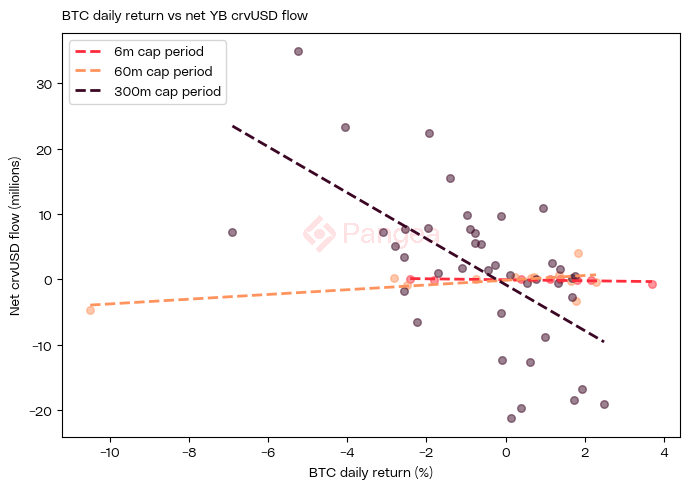

These directional flows are mechanically linked to BTC price movements. When BTC pumps/dumps, this creates in/outflow of crvUSD from YieldBasis to Curve. As caps raise, this means that the crvUSD peg is increasingly exposed to BTC volatility via YB, with large BTC moves triggering large, one-directional crvUSD flows. Currently, a +1% move in BTC causes YieldBasis to sell an average of $3.51m crvUSD.

Correlation of BTC daily returns to crvUSD flow from YieldBasis

Correlation of BTC daily returns to crvUSD flow from YieldBasis

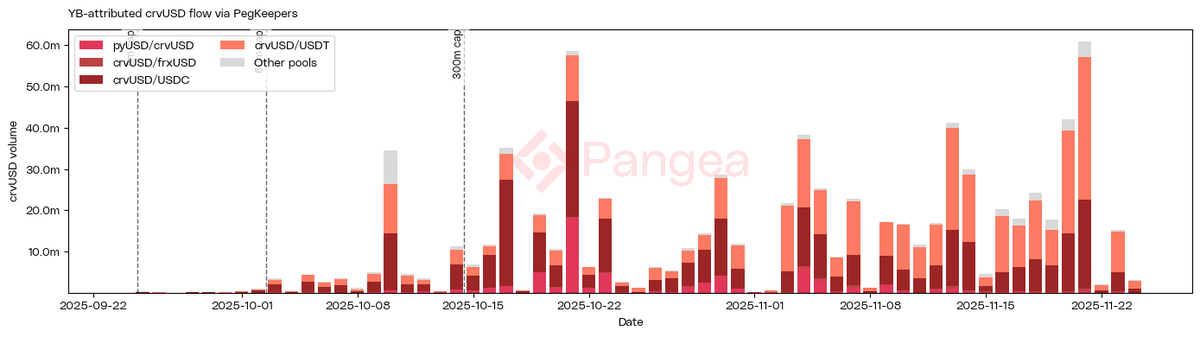

The absolute majority of this crvUSD volume is flowing through the PegKeeper pools, primarily the USDC and USDT pools. pyUSD makes a small contribution, whilst frxUSD and other crvUSD pools receive negligible flow. This is because traders tend to enter/exit swaps via USDC or USDT, not crvUSD.

crvUSD flow from YieldBasis in PegKeeper pools

crvUSD flow from YieldBasis in PegKeeper pools

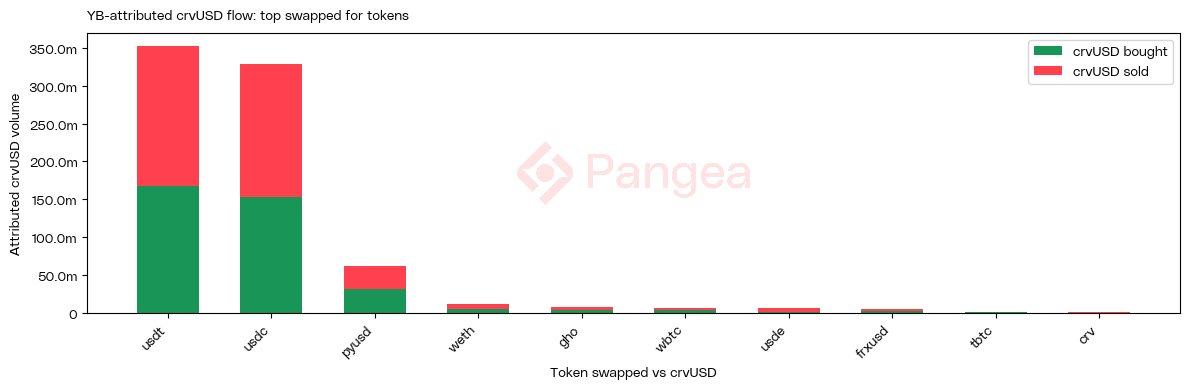

crvUSD flow from YieldBasis into other tokens

crvUSD flow from YieldBasis into other tokens

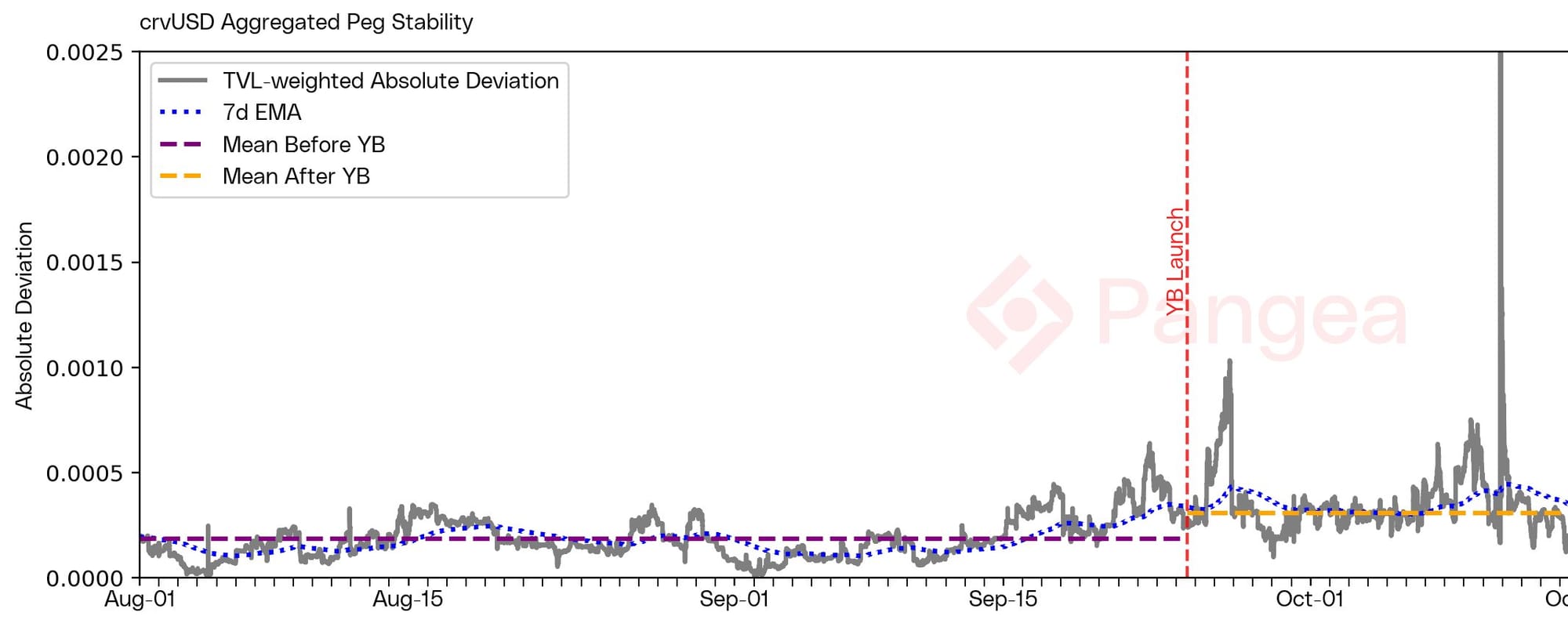

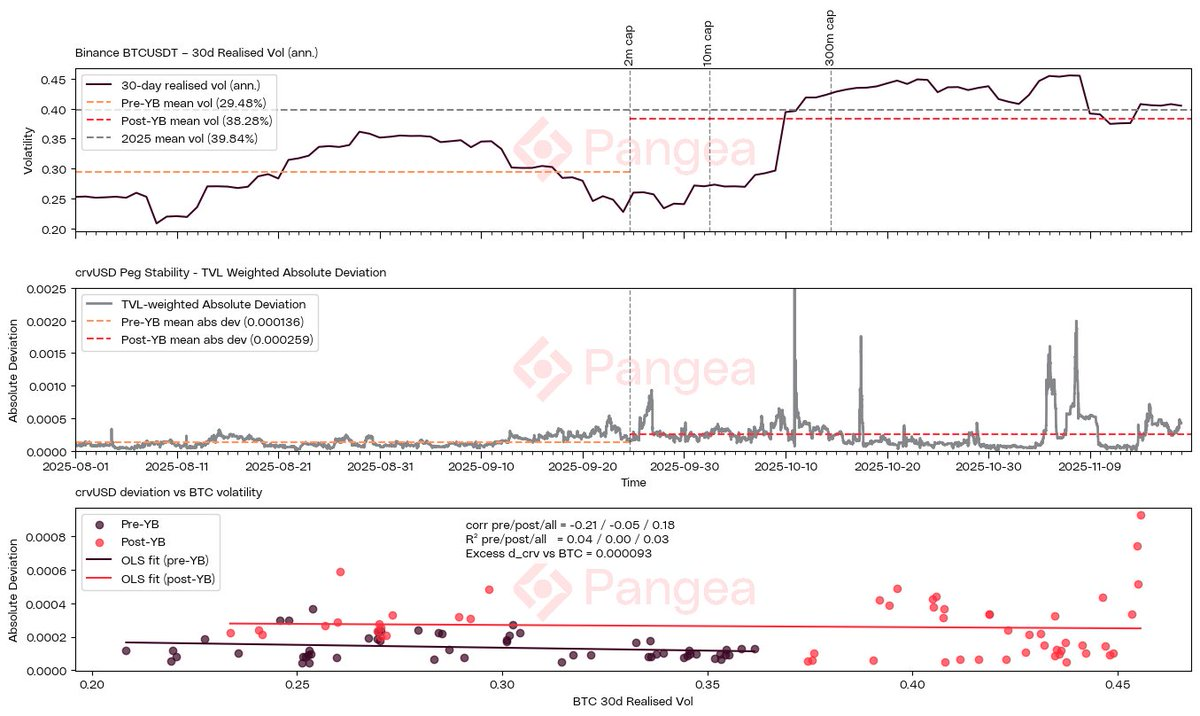

crvUSD has shown a 66.35% increase in the mean absolute deviation after the launch of YieldBasis compared to the equal period before, from 0.000186 to 0.000309. To put this in perspective, crvUSD is maintaining its peg at an average of >$0.9997, which is incredibly stable by any standard. This is thanks to the crvUSD peg stability levers: PegKeepers and dynamic borrow rates.

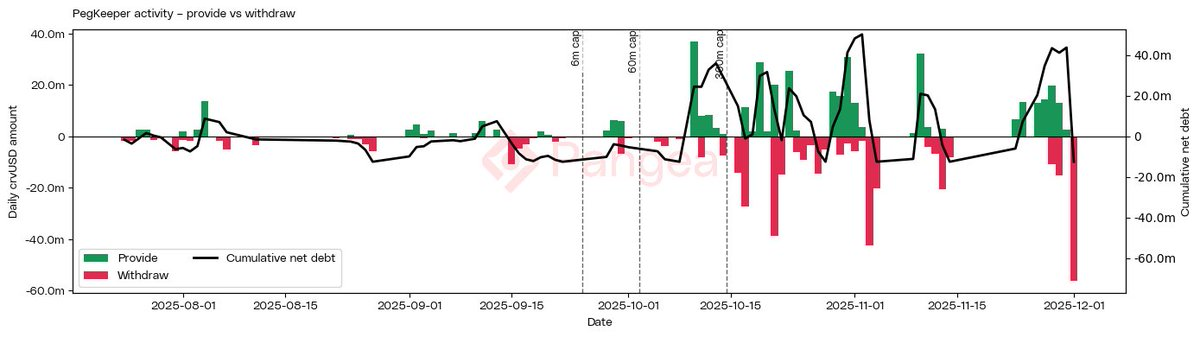

One-sided flow into crvUSD pools from YieldBasis causes deviations in the peg, which kicks the PegKeepers into action by providing or withdrawing crvUSD into the pools to counterbalance the depeg. The frequency and volume of PegKeeper activity has increased significantly since the launch of YieldBasis. Increasing caps on PegKeepers to allow them to handle higher volume in one direction was part of a series of proposals from Egorov to prepare for scaling YieldBasis.

PegKeeper daily crvUSD volume

PegKeeper daily crvUSD volume

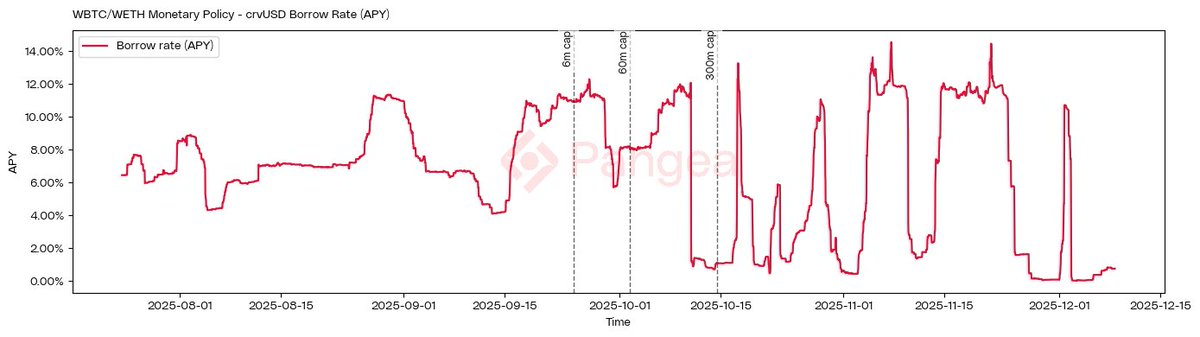

crvUSD minting rates are linked to both market utilisation and the crvUSD peg. Thus, just as the PegKeepers have been working overtime to keep crvUSD stable, borrow rates have also been highly variable. Despite historically low utilisation, rates have repeatedly peaked >12%, before falling back to almost 0%. Whilst we haven't seen an overall increase in the average borrow rate, we have seen increased rate volatility as crvUSD is pushed back and forth by YieldBasis flows. This creates unpredictability for borrowers on Curve and discourages short time-frame high-leverage trading.

crvUSD aggregate borrow rate for the WETH & WBTC markets

crvUSD aggregate borrow rate for the WETH & WBTC markets

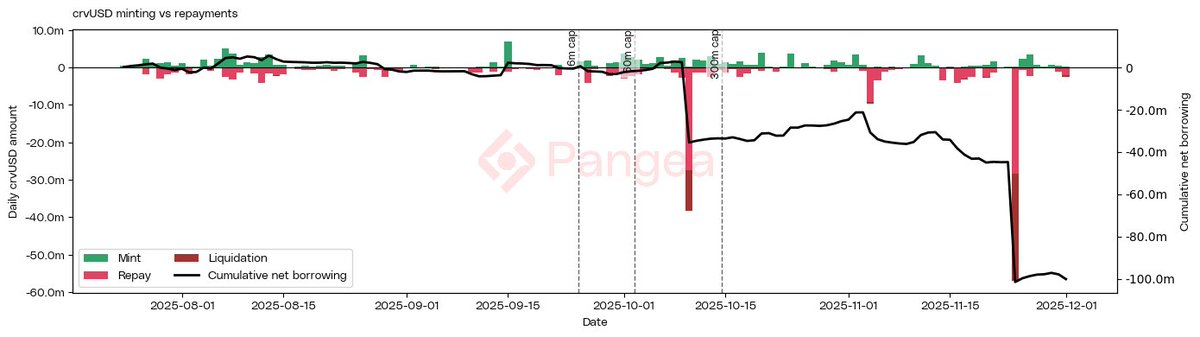

In theory, increasing borrow rates helps stabilise the peg as borrowers are encouraged to buy crvUSD from the market to close their positions. However, we have seen the supply of minted crvUSD decline significantly since the launch of YieldBasis. As an increasingly smaller proportion of crvUSD debt pays interest, the power of dynamic borrow rates to influence peg stability diminishes. A broad base of crvUSD mint utilisation is required to ensure that borrow rates remain an effective stabilisation lever, yet increased rate volatility discourages borrowing.

Daily crvUSD mint and repay volume

Daily crvUSD mint and repay volume

A general increase in market volatility since the launch of YieldBasis may account for some of these observations, such as the decline in crvUSD borrowing. However, whilst volatility has been elevated relative to the immediate period before, it remains below the average for the year. Regression analysis shows that, all things equal, changes in BTC volatility alone do not wholly account for the observed changes in the crvUSD peg deviation. Methodologically, trying to control for BTC volatility by considering counterfactual cases in aggregate is not a very fruitful method of analysis. The structural mechanisms detailed above more clearly identify the inherent relationship, which cannot be abstracted away.

Regression analysis between crvUSD peg deviation and BTC volatility

Regression analysis between crvUSD peg deviation and BTC volatility

Conclusion

Our research shows that structural flows from YieldBasis tightly couple the crvUSD system as a whole to BTC price movements.

YieldBasis is generating significant volume for Curve pools, which benefits Curve through increased fees. However, these flows also stress the peg stability mechanisms, which can have negative consequences for Curve through increased volatility in borrowing rates. Scaling YieldBasis to $1bn will require careful management of the risks to ensure these externalities are not amplified further.

Pangea has partnered with @LlamaRisk to conduct a joint risk analysis and provide actionable recommendations to help YieldBasis and Curve grow together. A new crvUSD monetary policy designed by LlamaRisk has already been voted in, but more time is needed before its effects can be assessed. As a result of our work together, further recommendations will soon be proposed to ensure YieldBasis scales to $1bn successfully.