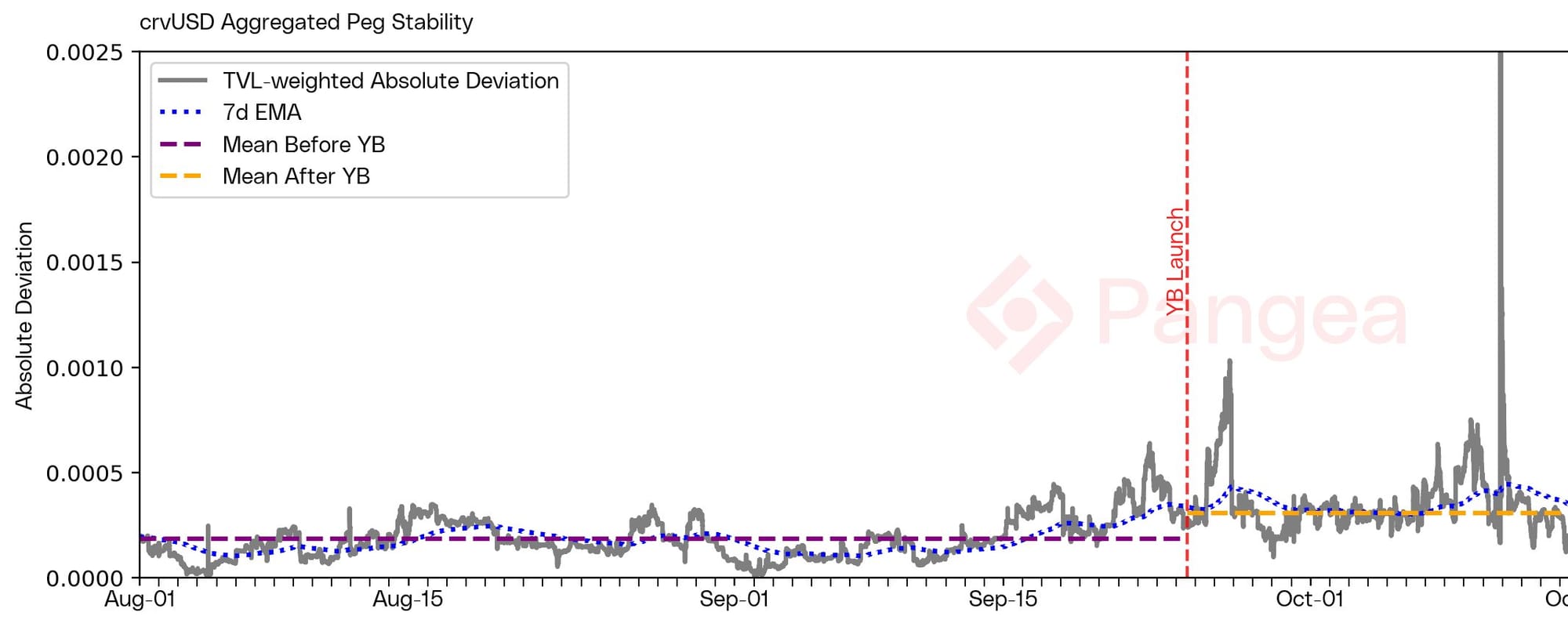

With @yieldbasis requesting an increased $1bn crvUSD credit line from the @CurveFinance DAO, we investigated crvUSD peg stability before and after the launch of YieldBasis.

Our findings show an increase in the volatility and peg deviation of crvUSD since the launch of YieldBasis.

Methodology

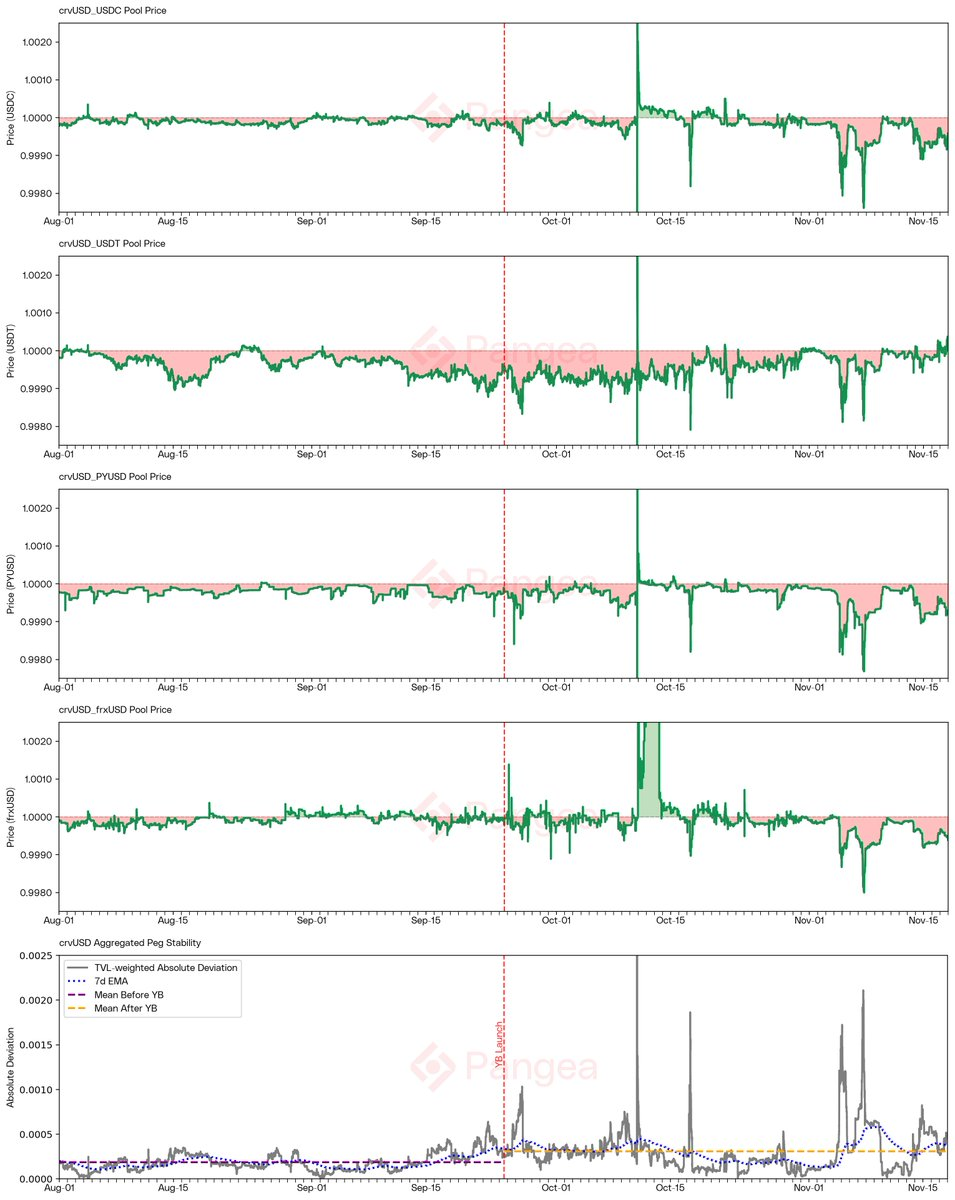

We gathered data on the end of block pool price for four crvUSD pools:

- crvUSD/USDC

- crvUSD/USDT

- crvUSD/PYUSD

- crvUSD/frxUSD

These pools were chosen because they are used by the PegKeepers and have largest TVL and volume of all crvUSD pairings.

The end of block pool price provides a realistic price that users could receive and is less prone to intra-block volatility from MEV than swap prices.

We analysed data for a range of equal time before and after the launch of YieldBasis.

Findings

We plotted the price for the four pools. We then weighted these prices by the pool TVL at each block to produce an aggregated measure of the crvUSD absolute deviation from peg.

crvUSD peg analysis

crvUSD peg analysis

Our findings show a 66.35% increase in the mean absolute deviation after the launch of YieldBasis, from 0.000186 to 0.000309.Our statistics for the individual pools are as follows:

crvUSD_USDC:

- mean_price: 0.999856

- median_price: 0.999874

- max_abs_dev: 0.067178

crvUSD_USDT:

- mean_price: 0.999592

- median_price: 0.999629

- max_abs_dev: 0.011850

crvUSD_PYUSD:

- mean_price: 0.999758

- median_price: 0.999819

- max_abs_dev: 0.037450

crvUSD_frxUSD:

- mean_price: 0.999943

- median_price: 0.999915

- max_abs_dev: 0.003214

The mean and median prices show that on the whole, crvUSD has remained very stable, keeping a price of at least 0.999 most of the time. However, there has been some significant volatility, particularly following the Oct 10 flash crash.

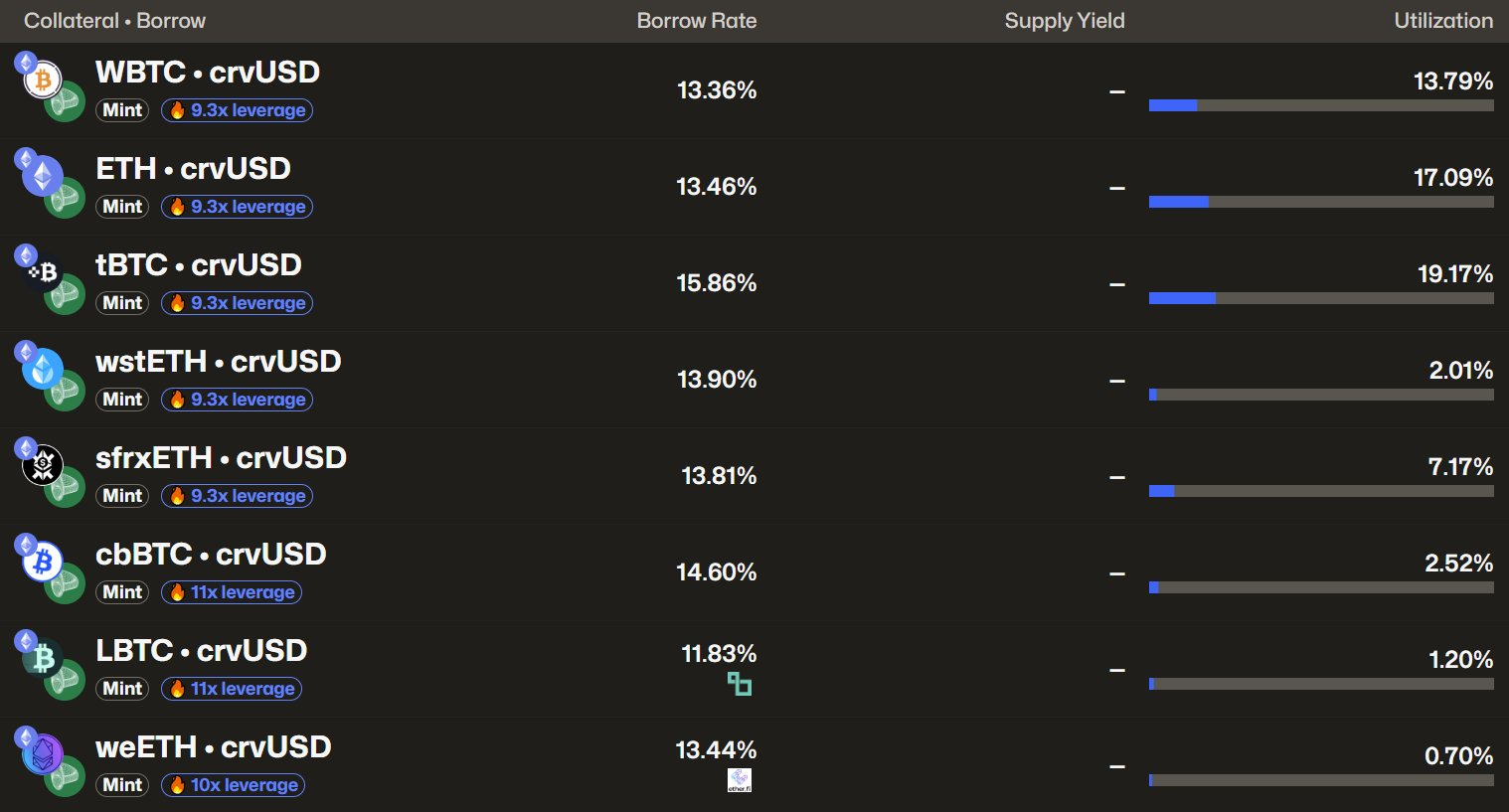

Curve has two primary levers for maintaining the crvUSD peg: PegKeepers and borrowing rates. These have so far been effective in maintaining a strong peg. However, both have been working overtime and this is beginning to show in volatile crvUSD borrowing rates, despite low utilisation. Thus, whilst the absolute crvUSD peg deviation appears minimal, the effect of peg instability appears in the PegKeepers and borrow markets as these are the first line of peg defence.

M

M

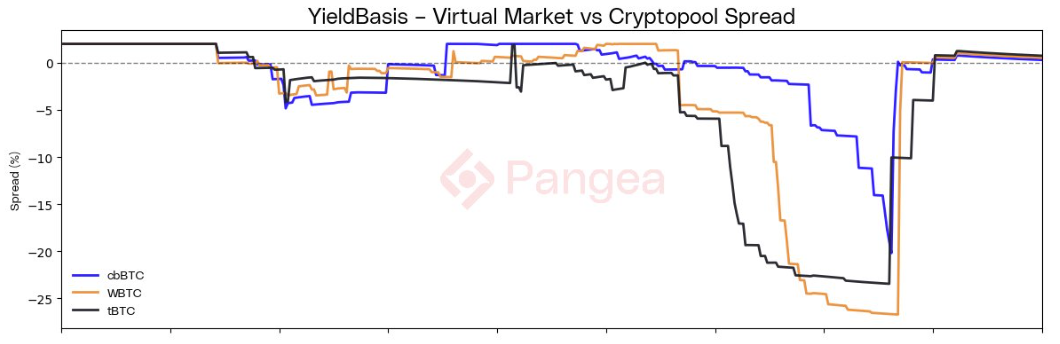

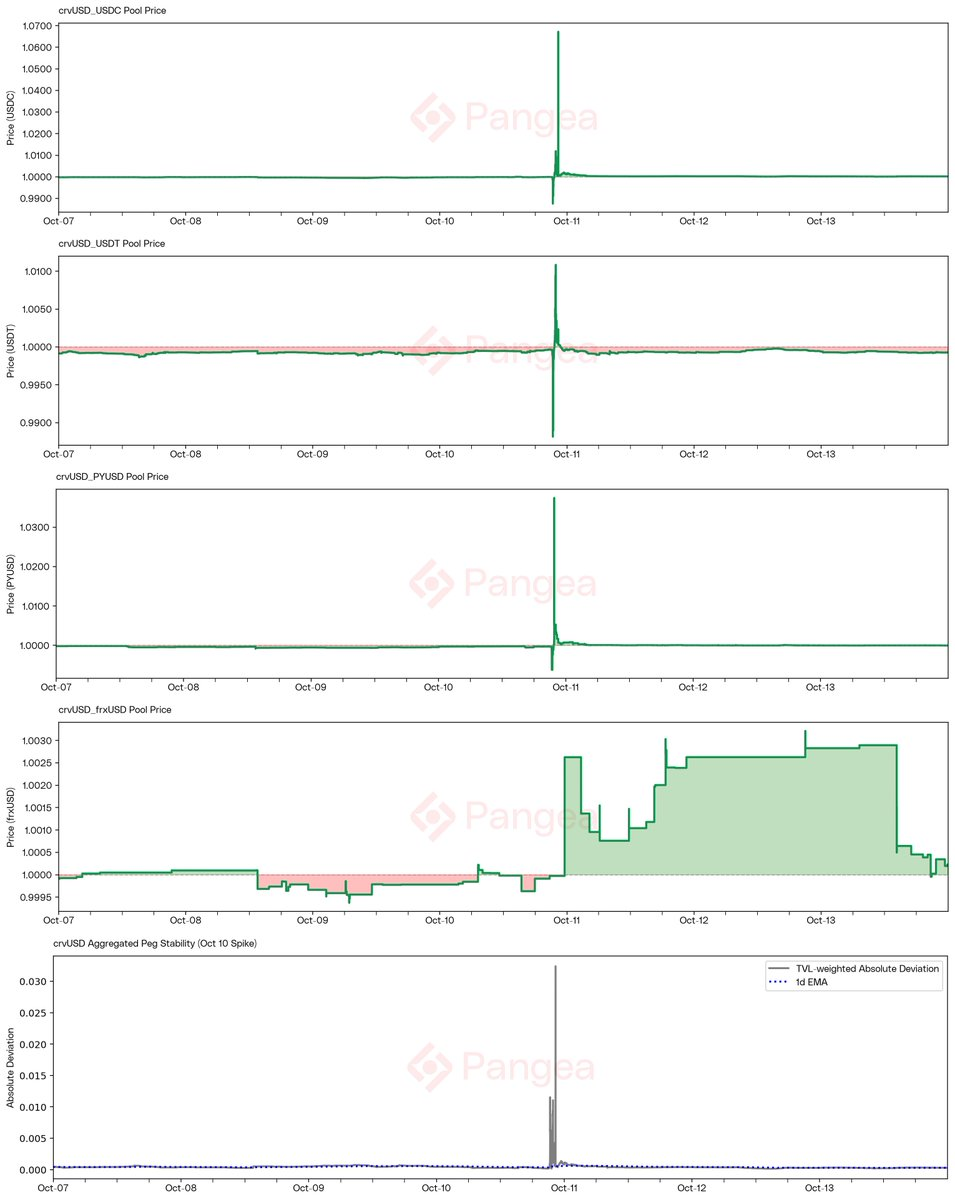

On Oct 10 the pool price shows a very large deviation in both directions across all pools, reaching as much as $0.067 for USDC. However, our investigation shows that this was due to a multi-block MEV strategy rather than a sustained structural depeg.

Oct 10 crvUSD peg stability

Oct 10 crvUSD peg stability

MEV bot 0x689 - AKA Yoink - paid over 35 ETH to builder 0x22 - AKA I can haz block? - to own the entire block 23550276. They used this privilege to extract value across many DeFi pools from arbitrage opportunities that had been created by the volatility. This included multiple large swaps in crvUSD pools, with the final transaction swapping through the crvUSD/USDC pool, skewing the end of block pool price. In the following block the same bot then performed further transactions which restored the balance of the pool.

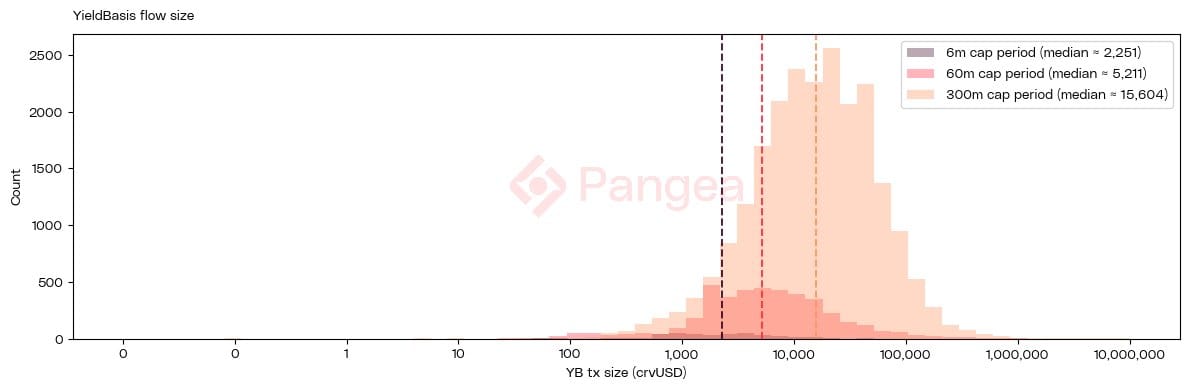

As our previous research has detailed, swaps in YieldBasis tend to flow through the crvUSD pools. When BTC price action is prevailing in one direction, this can induce significant volume in one direction through these pools, altering the balance of assets in the AMM and impacting the price.

This phenomenon was recognised in a proposal by Mich to scale crvUSD in preparation for further YieldBasis cap raises. Two mitigations were proposed:

- Raise the pegkeeper caps

- Provide incentives to deepen crvUSD liquidity

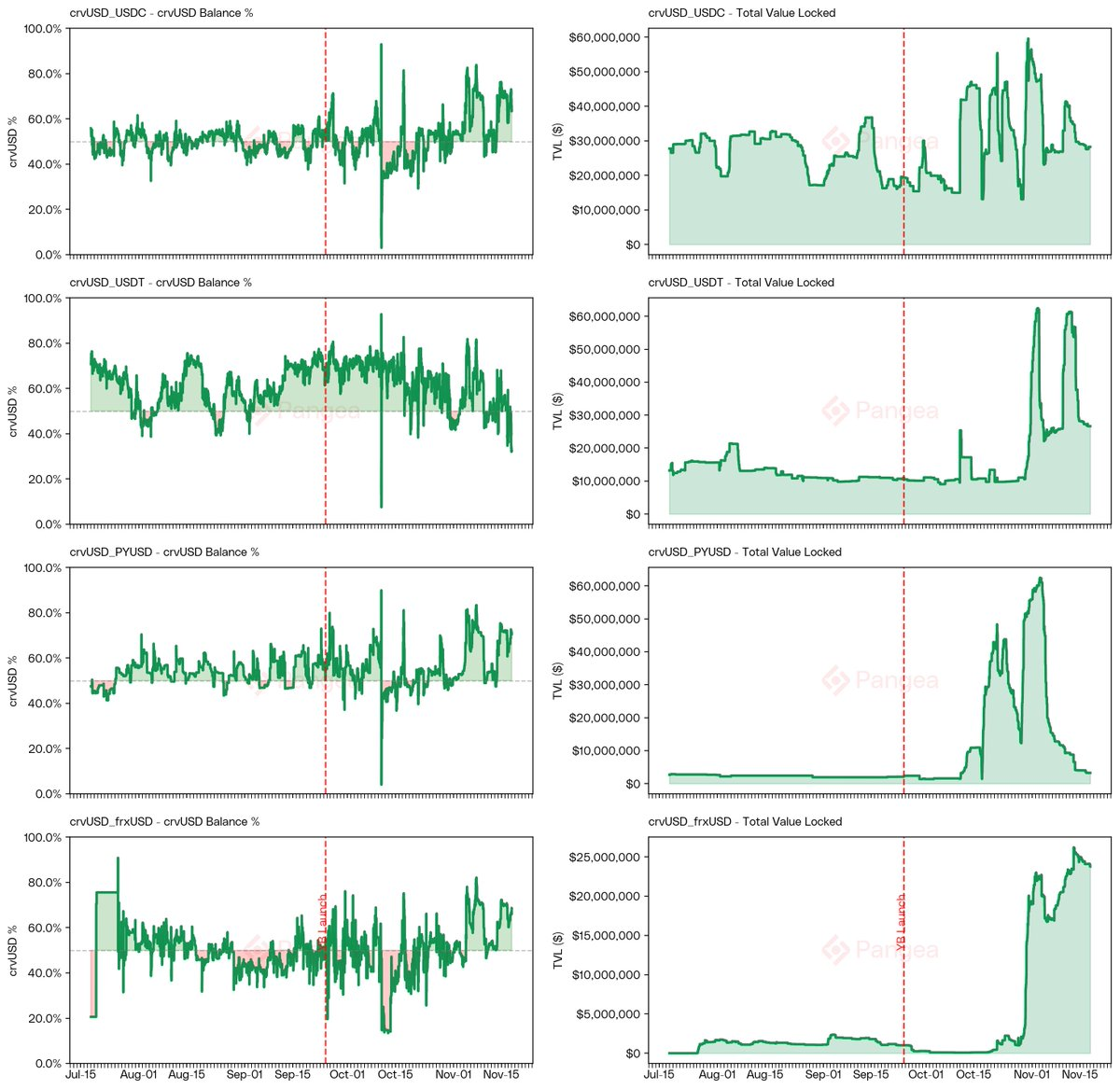

We looked at the TVL and coin balance of the crvUSD pools before and after the launch of YieldBasis to see the effect of these incentives on liquidity.

crvUSD Pool Balance and TVL

crvUSD Pool Balance and TVL

We can see large increases in TVL following the introduction of incentives, however this liquidity has not proven to be very sticky and (with the exception of frxUSD) has mostly left the pools as incentives tapered off. This is particularly evident in PYUSD which saw some of the highest incentives, growing from $2m to $30m before falling back to just over $2m again. Meanwhile, the balance of crvUSD in the pools has recently begun creeping up, putting a strain on the peg.

For YieldBasis to scale, crvUSD liquidity in these pools must also scale to support the resultant volume of flows without significant impact on the crvUSD peg. This liquidity needs to be sticky, providing reliable support day to day. However, the current data shows LPs to be relatively mercenary, withdrawing support as soon as incentives decrease.

Conclusion

Our findings show an increase in the volatility and peg deviation of crvUSD since the launch of YieldBasis, when compared with the equal period of time before launch.

However, we do not conclusively show that YieldBasis is the cause of the increased instability. Market volatility has been higher since the launch compared to the period before, so this is a factor that we would need to control for to isolate the effect of YieldBasis.

That said, the structural flows from YieldBasis give us good reason to believe that it is at least a contributing factor to crvUSD peg instability. Furthermore, incentives that were intended to mitigate the impact of YieldBasis flows by increasing crvUSD liquidity have not resulted in deep sticky liquidity.

More analysis is needed before we can draw firm conclusions about the exact mechanisms at play. However, we believe these initial findings motivate further study before raising pool caps to $1bn, to better understand the impact of YieldBasis on Curve's lending business and develop effective mitigations to help crvUSD and YieldBasis scale safely.