crvUSD Monetary Policy is changing, but what does it mean for users and system stability?

In this article we dive into what the Monetary Policy is, how and why it's changing, and what that means for users and the system.

Stability Mechanisms

crvUSD is a decentralised CDP stablecoin from @CurveFinance that can be minted against ETH or BTC collateral. That means every 1 crvUSD is backed by more than $1 in crypto collateral.

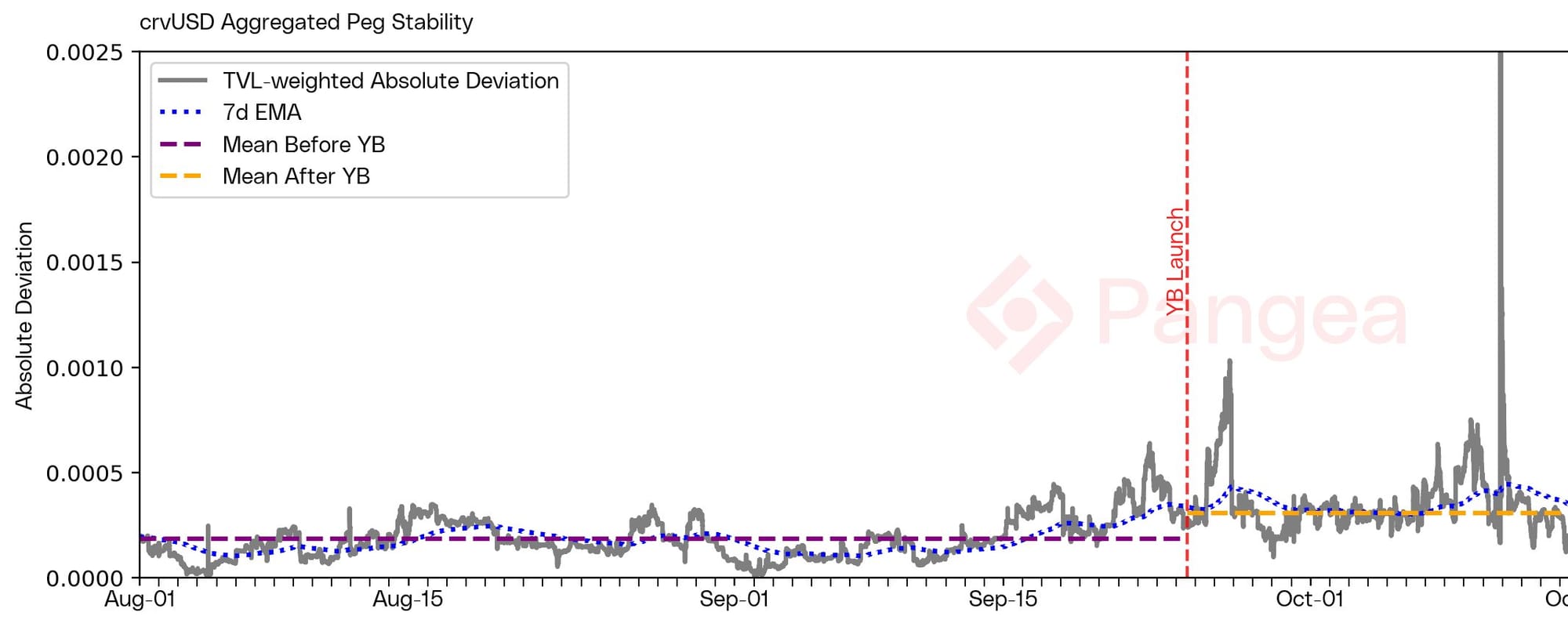

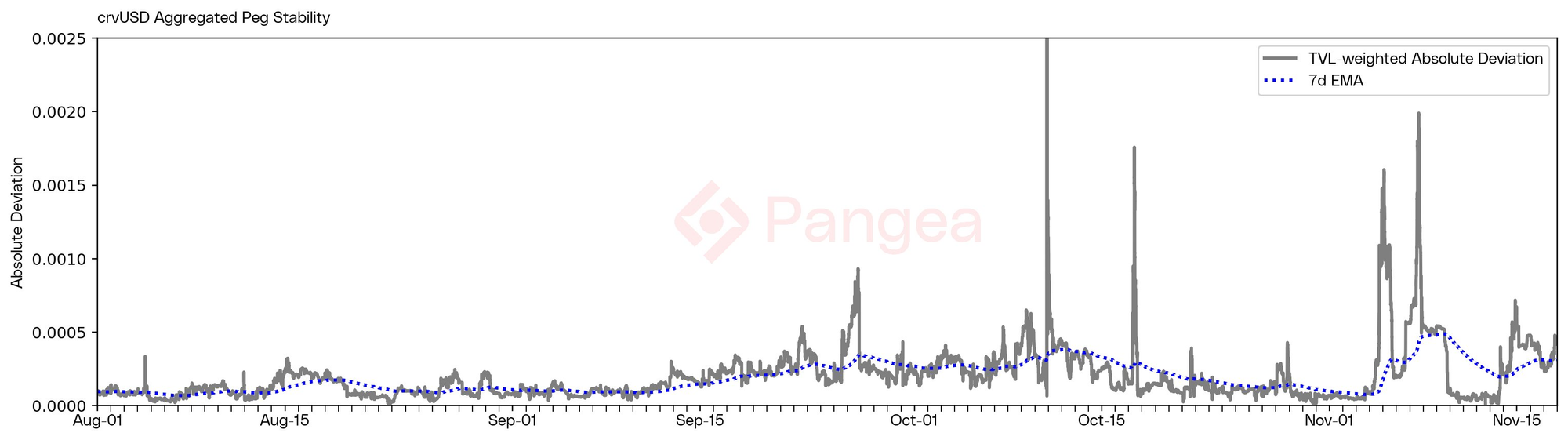

As our research has shown, crvUSD has impressive stability, maintaining an average peg of 0.9997 in recent months.

It achieves this stability through two primary mechanisms - PegKeepers (PK) and variable borrow rates.

PegKeepers

When the crvUSD aggregated oracle price rises above $1 the system mints crvUSD into the PK pools, effectively selling for other stablecoins like USDC and USDT to bring the price down. This minted crvUSD creates PK debts which are tracked in the system. There is a limit to how much debt each PK can accrue.

When the oracle price falls below $1 the pegkeepers burn the previously minted crvUSD, removing it from the pool and bringing the price up. Burning settles the PK debts previously accrued by minting. Thus, crvUSD in PegKeepers can only be burned insofar as there is PK debt.

Rates

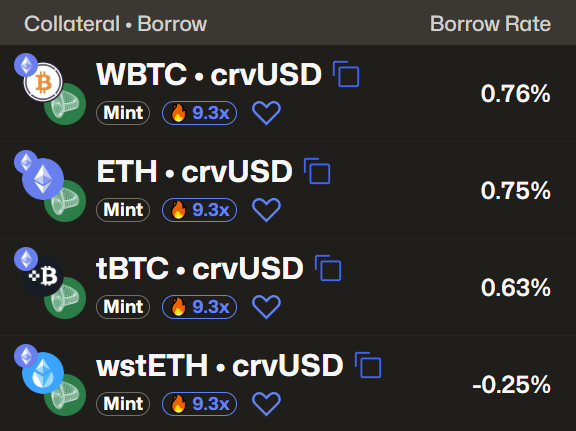

Borrowers pay a variable rate of interest which changes dynamically. If crvUSD depegs and/or PK debt is excessive, borrow rates will either rise or lower accordingly.

Higher rates help to push the crvUSD price up, encouraging borrowers to buy crvUSD from the market to close positions.

Lower rates have the opposite effect effect, pushing the crvUSD price down as borrowers open positions and sell to the market.

crvUSD mint rates

crvUSD mint rates

How exactly rates respond to these factors is determined by the Monetary Policy.

Monetary Policy

The Monetary Policy contract defines the exact mathematical relationships which determine the dynamics of borrow rates. Think of it as an algorithmic Federal Reserve.

Three ingredients input to the monetary policy:

- Target rate

- crvUSD price oracle

- PegKeeper debt share

The target rate (rate0) is what borrowers would pay in the ideal case where crvUSD is at $1 and there are no PK debts.

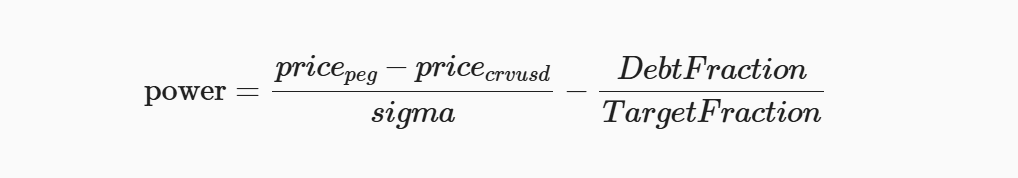

The price oracle determines the deviation of crvUSD from its $1 peg. The effect of this on rates is determined by the sigma value defined in the policy.

Debt fraction is the proportion of PK debt relative to overall debt. A target fraction is also defined in the policy.

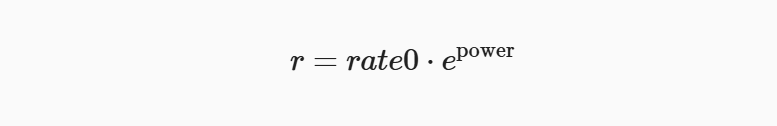

The actual rate is therefore a consequence of the target rate, the price oracle relative to sigma, and the debt fraction relative to target fraction.Mathematically, rate (r) is a product of the target rate (rate0) scaled exponentially by power.

Where power is defined as the difference between crvUSD deviation relative to sigma and the PK Debt Fraction relative to Target Fraction.

Policy Shift

So how and why is the policy changing?

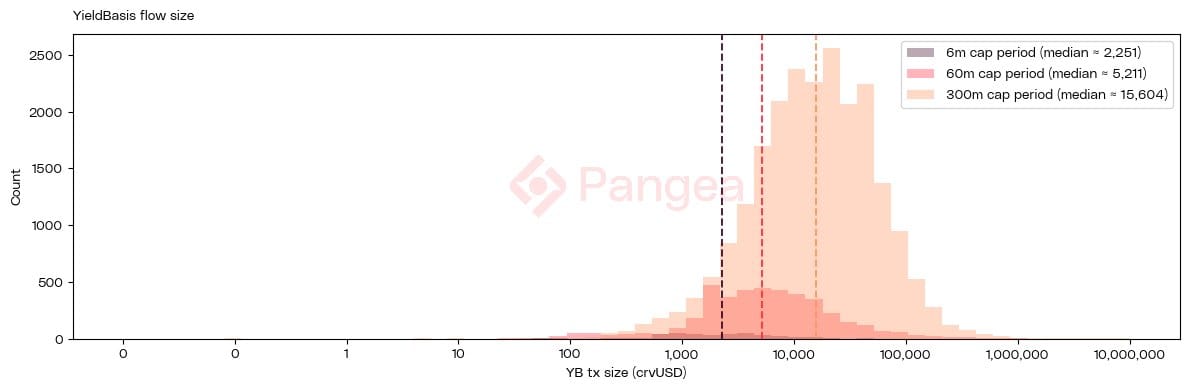

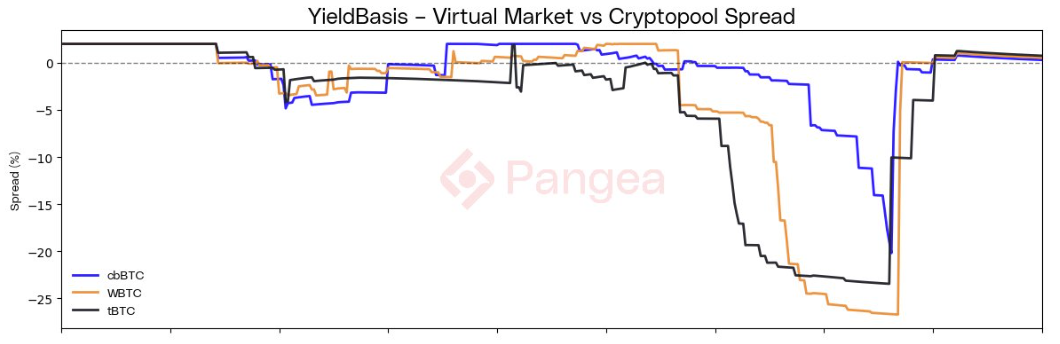

The expansion of $315m crvUSD in credit lines to @YieldBasis and @ResupplyFi outside of the usual mint and burn framework has created new dynamics affecting the crvUSD system.

Structural flows from YieldBasis have induced peg deviations which cause PegKeepers to work overtime to hold crvUSD steady.

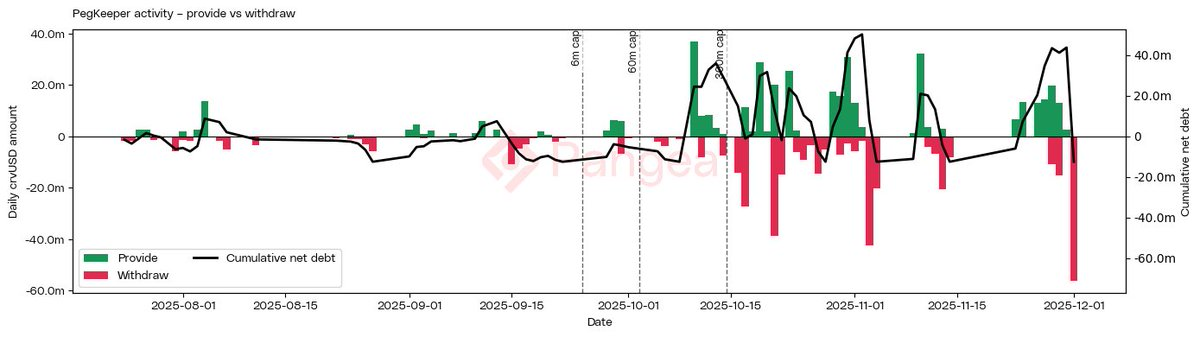

PegKeeper activity

PegKeeper activity

At the same time, crvUSD borrowed from the mint markets has decreased significantly as crypto markets deleverage following the Oct 10 flash crash.

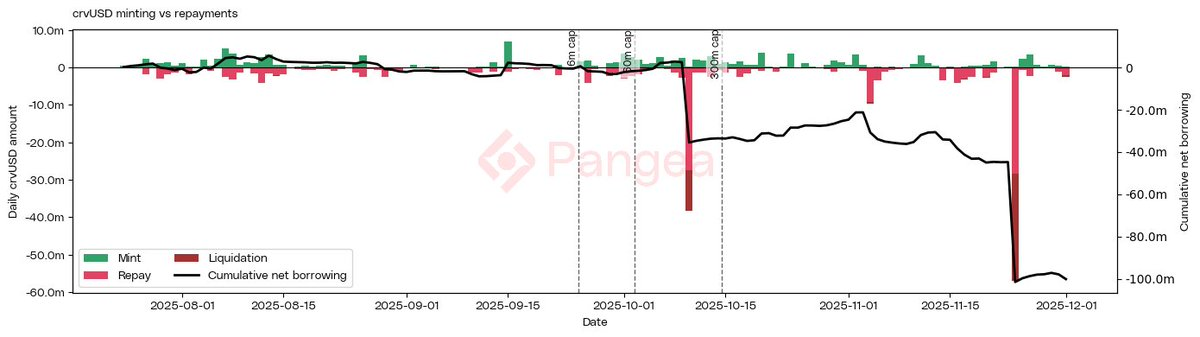

Mint market activity

Mint market activity

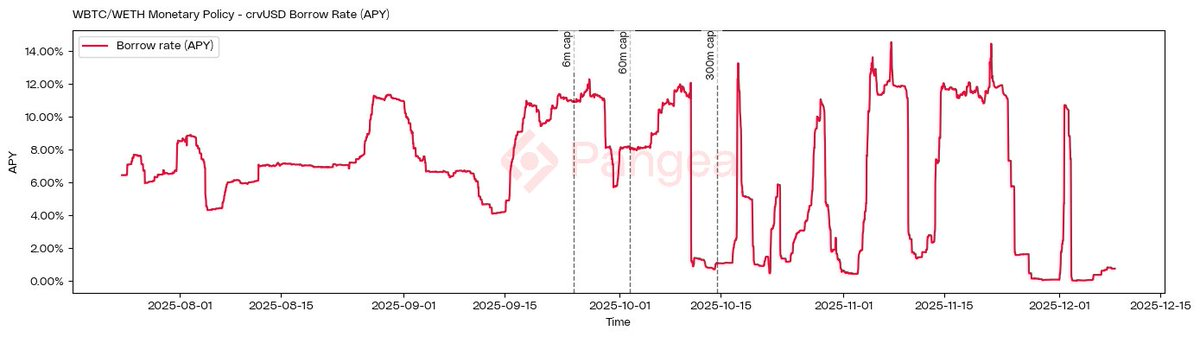

The effect has been that borrowing rates have become much more volatile than comparable markets. This creates a less predictable experience for borrowers and discourages high-leverage positions.

Aggregated WETH & WBTC mint rate

Aggregated WETH & WBTC mint rate

If you are interested in learning more, you can read our full research article explaining the impact of YieldBasis on the crvUSD system.

Two proposals are currently underway to address rate volatility.

LlamaRisk's Proposal

The first proposal comes from @LlamaRisk and involves adjusting the Target Fraction and Target Rate.

Falling total debt combined with increased PegKeeper activity means that PK debt is increasingly dominating rate changes, creating volatile rates for borrowers.

Raising the Target Fraction (i.e. between PK debt and overall debt) reduces the impact of fluctuations in PK debt.

Reducing the Target Rate makes borrowing more competitive relative to alternatives such as @Aave, encouraging minting.

When overall debt rises due to more mints, the impact of volatile PK debt on the rate reduces, ensuring more stable the markets.

Egorov's Proposal

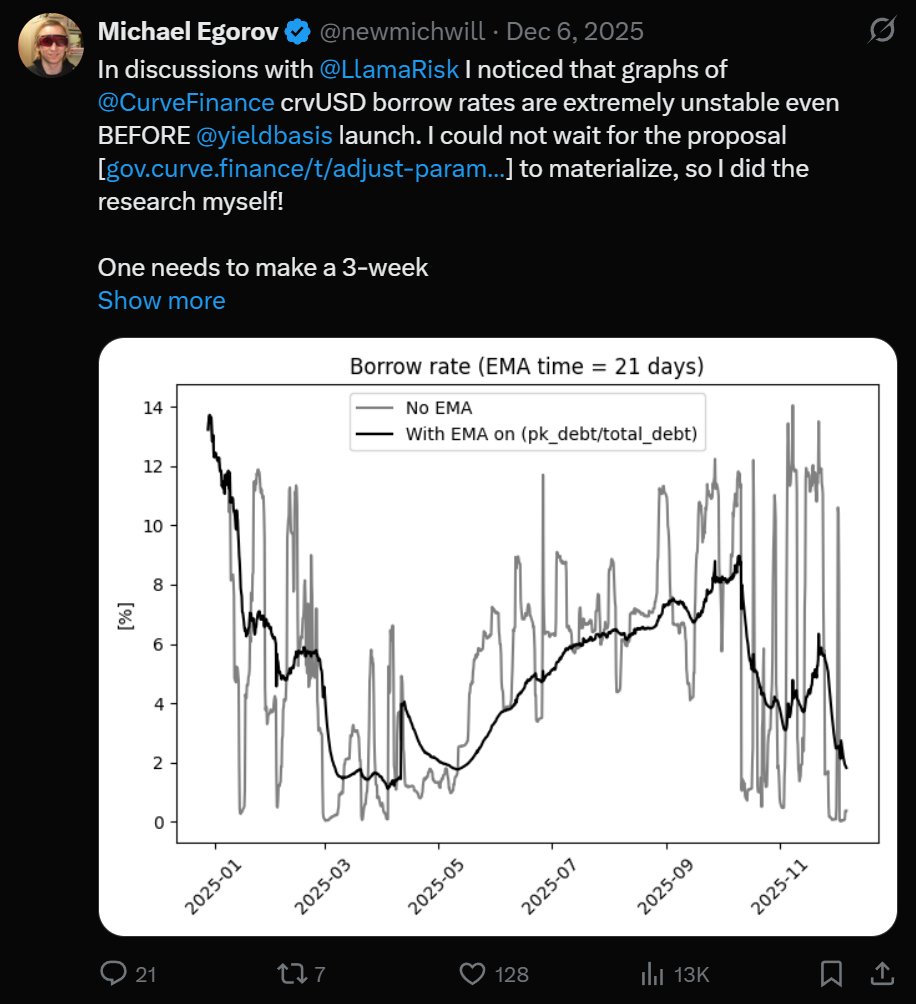

LlamaRisk's proposal also suggested applying some smoothing on the rate itself for a more gradual change. This was picked up by Curve and YieldBasis founder @newmichwill, who shared his research on optimal smoothing.

Applying a 3-week Exponential Moving-Average (EMA) on the PK debt to total debt ratio results in a much smoother rate without compromising on system stability.

Rates will still be sensitive deviations in the crvUSD peg, but won't be pushed around so much by the PegKeeper activity when it counterbalances YieldBasis flows.

Next Steps

crvUSD minting has proven to be a lucrative business for Curve and an important pillar of overall system stability. These changes to monetary policy should reduce borrow rate volatility, giving users a more predictable experience and encouraging crvUSD minting.

Just like Federal Reserve rate changes, the effects of these policy shifts will take some time to generate meaningful observations. Pangea will be watching the data closely to see if they have been successful.

Pangea has partnered with LlamaRisk to provide the insights needed to power their risk analysis.

They are working on further recommendations to ensure the stability of the system as YieldBasis scales to utilise the recently proposed $1bn crvUSD credit line.

Liquidity concentrated by YieldBasis.

Credit supplied by Curve.

Risks managed by LlamaRisk.

Insights powered by Pangea.

This is the frontier of DeFi.